Functional Non-Meat Ingredients Market Size Worth USD 189.72 Billion by 2034 | Towards FnB

According to Towards FnB, the global functional non-meat ingredients market size is evaluated at USD 126.57 billion in 2025 and is anticipated to surge USD 189.72 billion by 2034, reflecting at a CAGR of 4.6% from 2025 to 2034. This growth trajectory reflects the rising demand for alternative protein sources, clean-label products, and healthier food options worldwide.

Ottawa, Nov. 12, 2025 (GLOBE NEWSWIRE) -- The global functional non-meat ingredients market size was valued at USD 121 billion in 2024 and is anticipated to increase from USD 126.57 billion in 2025 to reach around USD 189.72 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is growing rapidly lately due to higher demand for plant-based protein alternatives, clean-label products, and health-conscious consumers worldwide.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5805

Key Highlights of Functional Non-Meat Ingredients Market

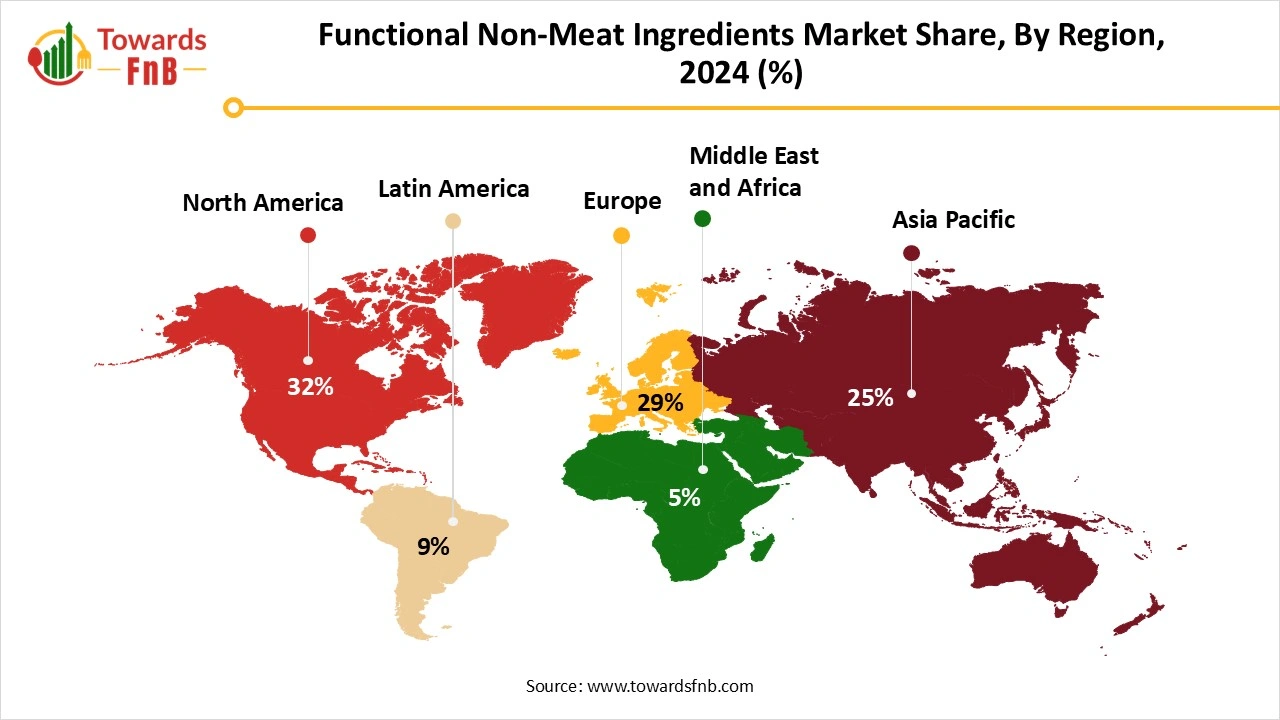

- By region, North America led the functional non-meat ingredients market with largest share of 32% in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By ingredients, the binders and extenders segment led the market with highest share of 24% in 2024, whereas the proteins segment is expected to grow in the foreseen period.

- By function, the water binding and retention segment captured the maximum share of 27% in 2024, whereas the fat reduction and replacement segment is expected to grow in the foreseeable period.

- By source, the plant-based ingredients segment dominated the market with largest share of 38% in 2024 and is also expected to grow in the forecast period.

- By distribution channel, the B2B sales segment led the market with largest share of 55% in 2024, whereas the online channel sales segment is expected to grow in the forecast period.

Rising Demand for Plant-Based Alternatives is helpful for the Growth of the Functional Non-Meat Ingredients Industry

The functional non-meat ingredients market is observed to grow lately due to factors such as rising health consciousness, higher demand for plant-based food options and sustainable alternatives, along with enhanced shelf life of products. The market is also observed to grow due to the benefits of using such ingredients, such as enhanced shelf life, improved taste and texture, improved quality, and improved binding capacity, further fueling the market’s growth. The market is also expected to grow due to the rising numbers of vegans and flexitarians, along with higher demand for convenient food options, which will support the market’s growth.

Impact of AI in the Functional Non-Meat Ingredients Market

Artificial intelligence is transforming the functional non-meat ingredients market by enhancing innovation, improving process efficiency, and enabling data-driven decision-making across the food production chain. In research and development, AI-powered algorithms analyze vast datasets on ingredient functionality, sensory properties, and nutritional composition to identify optimal ingredient blends that improve texture, flavor, and moisture retention in processed meat alternatives. Machine learning models simulate ingredient interactions, such as binders, emulsifiers, and stabilizers, to develop plant-based or hybrid formulations that mimic the sensory qualities of traditional meat while meeting consumer expectations for taste, appearance, and mouthfeel.

AI-driven predictive analytics optimize production parameters, such as mixing ratios, temperature, and processing time, ensuring consistent quality and reducing production waste. Computer vision systems are used to detect inconsistencies or impurities during ingredient processing, supporting stringent quality control and food safety compliance. AI also assists in the development of clean-label and functional formulations by identifying natural alternatives to synthetic additives, aligning with the growing demand for healthier, minimally processed products.

Recent Developments in Functional Non-Meat Ingredients Market

- In May 2025, Eat Just Inc. launched its clean protein with only protein as its ingredient, with the help of cutting-edge science and technology, and with the aim of creating sustainable and healthier solutions. (Source- https://www.businesswire.com)

- In October 2025, Verley, a French startup, is expecting to launch precision fermented whey proteins in 2026, after getting the FDA GRAS approval. (Source- https://www.greenqueen.com.hk)

View Full Market Intelligence@ https://www.towardsfnb.com/insights/functional-non-meat-ingredients-market

New Trends of Functional Non-Meat Ingredients Market

- Higher demand for plant-based meat and protein alternatives, along with higher demand for clean-label products, is one of the major factors for the market’s growth.

- Improved technology helps to maintain the taste and texture of plant-based options, which is another major factor for the market’s growth.

- Higher demand for eco-friendly and sustainable options also helps to fuel the growth of the functional non meat ingredients market.

- The growing population of health-conscious vegans and flexitarians is another major factor for the market’s growth.

Product Survey — Global Functional Non-Meat Ingredients Market

| Product Category | Description / Function | Common Ingredient Types / Examples | Key Applications / End-Use Sectors | Leading Companies / Producers |

| Binders & Extenders | Improve texture, water-holding capacity, and yield in processed meat and analog products. | Soy protein concentrate, wheat gluten, carrageenan, starches | Sausages, nuggets, patties, deli meats, meat alternatives | Kerry Group, Ingredion, ADM, DuPont (IFF), Cargill |

| Phosphates & Salt Replacers | Enhance juiciness, texture, and protein binding; also used to replace sodium phosphates for clean-label formulations. | Sodium tripolyphosphate, potassium chloride, calcium citrate | Processed meats, marinated meats, and low-sodium meat products | Innophos, BK Giulini, ICL Group, Budenheim |

| Hydrocolloids (Stabilizers & Thickeners) | Provide viscosity, gel formation, and water retention; crucial for emulsified and restructured meats. | Carrageenan, alginate, xanthan gum, guar gum | Deli meats, hams, sausages, plant-based analogs | CP Kelco, Tate & Lyle, Cargill, Kerry Group |

| Emulsifiers | Stabilize fat-water emulsions and improve meat batter consistency. | Lecithin, mono- and diglycerides, DATEM | Sausages, meat spreads, emulsified hams | Palsgaard, Corbion, ADM, DuPont |

| Antioxidants | Prevent lipid oxidation, extend shelf life, and maintain flavor and color. | Ascorbic acid, tocopherols, rosemary extract, BHA/BHT | Processed meats, cured meats, ready-to-eat meals | Kemin Industries, Corbion, DSM-Firmenich, Kerry Group |

| Preservatives & Antimicrobials | Extend shelf life by preventing microbial growth; key for safety and quality. | Sodium nitrite, lactate, acetate, vinegar, natural ferments | Cured meats, cooked meats, refrigerated products | Corbion, DuPont (IFF), Kemin, Niacet |

| Flavor Enhancers & Seasoning Blends | Improve or restore flavor lost during processing or freezing. | Yeast extracts, hydrolyzed vegetable protein (HVP), monosodium glutamate, natural flavor blends | Sausages, burgers, soups, gravies, and plant-based meats | Givaudan, Kerry Group, Sensient Technologies, Symrise |

| Coloring Agents | Impart or stabilize desirable meat color in both meat and analog products. | Natural: beet extract, paprika, carmine; Synthetic: nitrosomyoglobin stabilizers | Processed meats, cured meats, meat analogs | DDW (Givaudan), Chr. Hansen, Kalsec, Sensient |

| Proteins (Functional Texturizers) | Improve structure, elasticity, and mouthfeel in meat and non-meat analogs. | Soy protein isolate, pea protein, wheat gluten, milk proteins | Plant-based meats, hybrid meat analogs, surimi | Cargill, ADM, Roquette, BENEO |

| Enzymes | Used for texture modification, tenderization, and clean-label binding. | Transglutaminase, proteases, and amylases | Reformed meats, hams, nuggets, surimi, analog meats | Ajinomoto, DSM-Firmenich, Kerry Group, Novozymes |

| Fats & Oils (Functional Lipids) | Enhances juiciness and flavor; used as an animal fat replacer in meat analogs. | Coconut oil, canola oil, sunflower oil, structured lipids | Plant-based meats, patties, and emulsified products | AAK, Cargill, Bunge, Wilmar International |

| Fibers & Texturizing Agents | Provides bulk, water retention, and improves bite quality; also used for calorie reduction. | Citrus fiber, bamboo fiber, oat fiber, inulin | Low-fat meats, restructured meat products, plant-based analogs | JRS Rettenmaier, Fiberstar, Tate & Lyle |

| Clean-Label Functional Ingredients | Natural alternatives replacing synthetic stabilizers, preservatives, and emulsifiers. | Vinegar extracts, celery powder, acerola extract, citrus fiber | Clean-label cured meats, organic meat products | Corbion, Kemin, Kerry, DSM-Firmenich |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5805

Trade Analysis of the Functional Non-Meat Ingredients Market

Import & Export Statistics

What’s Traded (product types & HS proxies)

- Plant protein concentrates & isolates (pea protein isolate, soy concentrate/isolate, wheat gluten) HS proxies: protein concentrates, flours/powders.

- Texturizing intermediates (TVP blocks, hydrated mycoprotein cakes shipped frozen or chilled, textured pea/wheat flakes) — often traded under processed vegetable protein or frozen preparations headings.

- Functional starches & hydrocolloids (modified starches, methylcellulose, xanthan, konjac) used for binding, water retention, bite, and sliceability.

- Fat systems and oleogel solutions (specialty oils, hydrogenation alternatives, structured fats) — shipped as oils, emulsions, or preblends.

- Flavor systems & yeast extracts (umami enhancers, meat-like flavor bases) traded as concentrates or dry blends.

- Fermentation-derived ingredients (heme analogs, single-cell proteins, enzyme-treated concentrates) — high-value, often traded as specialty biotech ingredients.

-

Ancillary ingredients (salt replacers, phosphate alternatives, antioxidants for shelf life).

Top Exporter Geographies (who supplies the world)

- United States & Canada — Major exporters of pea protein isolates, textured soy/pea ingredients and specialized starches; strong co-packing and ingredient R&D networks support high-value B2B exports.

- European Union (Netherlands, Germany, France, Belgium) — Leading exporters of refined plant proteins, hydrocolloids, methylcellulose, specialty emulsifiers and yeast extracts. The Netherlands and Belgium also act as consolidation/re-export hubs.

- China — Large exporter of textured vegetable protein (TVP), wheat gluten, and low-cost protein concentrates and processing lines; significant for volume supply to developing markets.

- India — Growing exporter of pea/faba precursors, textured pulses, and spice-integrated meat-alternative bases; strong raw pulse supply and emerging fractionation capacity.

- Brazil & Argentina — Exporters of soy protein ingredients and oil/fat systems; strategic for markets needing scale and cost competitiveness.

- Specialist origins (Israel, Denmark, Netherlands) — Export fermentation-derived analogs, mycoprotein technology and high-value flavor/texture systems.

Top Importers / Demand Centres (who buys)

- North America (U.S., Canada) — large domestic industry but still imports specialty isolates, novel hydrocolloids and flavor systems for high-end plant-based production.

- European Union — major importer of refined protein isolates, binders and flavor systems to feed extensive meat-alternative and processed-food manufacturers.

- Asia (China, Japan, South Korea, SEA) — Fast-growing import markets for finished meat analog components and specialty isolates, especially in premium and urban segments.

- Latin America & MENA — Importers of cost-competitive TVP and protein concentrates for local manufacturing and re-exports.

Typical Trade Flows & Transaction Patterns

- Bulk B2B ingredient shipments (FCL): most trade is containerized bulk powders or sacks (25–1,000 kg) shipped to ingredient processors or co-packers.

- Project & OEM shipments: turnkey ingredient systems (preblended meal bases or hydrated TVP plates) shipped chilled/frozen for immediate use in co-pack plants.

- Private-label & small-lot DTC: finished hybrid/meat-alternative components sometimes flow as finished goods in smaller lots via parcel and refrigerated LTL channels.

- Licensing & tech transfer: beyond physical trade, many exporters sell formulation IP, pre-blends and co-manufacturing services across borders.

Government Initiatives

Governments worldwide are promoting technological innovation and sustainability in the food processing sector, thereby indirectly boosting the adoption of AI in the functional non-meat ingredients market. In the United States, the Department of Agriculture (USDA) and the Food and Drug Administration (FDA) are encouraging the adoption of AI-driven food safety systems and smart manufacturing practices to enhance transparency and quality assurance.

The European Union’s “Farm to Fork Strategy” and “Digital Europe Programme” are supporting the integration of AI in sustainable food production, including the development of plant-based and alternative protein ingredients. Meanwhile, countries like Singapore, Japan, and India are investing in AI-enabled food innovation hubs to advance functional ingredient research and improve domestic food self-sufficiency.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Functional Non-Meat Ingredients Market Dynamics

What Are the Growth Drivers of the Functional Non-Meat Ingredients Market?

Higher demand for plant-based protein alternatives and a growing population of health-conscious consumers are among the major factors driving market growth. The growing population of vegans and flexitarians is another vital factor driving market growth. High demand for plant-based convenient food options that are ready-to-eat or ready-to-prepare by consumers with a hectic schedule also helps in the growth of the functional non-meat ingredients industry. The segment also contributes to sustainability and ethical factors, including animal welfare.

Challenge

High Production Cost is hampering the Market’s Growth

Elevated production costs and costs associated with advanced technology are major issues for the market's growth. It also affects the final product's costs, creating constraints on market growth. Hence, price-conscious consumers may step back and not be part of the market's growth. The functional non-meat ingredients, such as plant-based proteins, starches, and hydrocolloids, required in the manufacturing of different types of plant-based products are high in costs, which may also hamper the growth of the market.

Opportunity

Rising Technological Advancements are helpful for the Market’s Growth

Rising technological advancements are a major factor in the market's growth. The cutting-edge technology helps in the manufacturing of new and innovative ingredients that help fuel the market's growth. New cutting-edge technology, such as the encapsulation technique, helps in the formation of effective functional non-meat ingredients that have extended shelf life, helpful for the growth of the market. Improving technology in the formation and processing techniques is another major opportunity for market growth.

Functional Non-Meat Ingredients Market Regional Analysis

North America Dominated the Functional Non-Meat Ingredients Market in 2024

North America led the functional non-meat ingredients market in 2024 due to rising demand for plant-based meat alternatives, plant-based protein options, and a growing population of health-conscious consumers, fueling the growth of the market. Improvement in research and development further fuels the growth of the functional non-meat ingredients industry. Higher demand for plant-based proteins such as wheat gluten, pea protein, and soy is another major factor driving market growth. The US plays a major role in the growth of the regional market due to ethical, sustainable, and wellness factors.

Asia Pacific Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Asia Pacific is expected to be the fastest-growing region over the forecast period due to factors such as growing demand for plant-based options, rising innovation and technology, rapid urbanization, and supportive government policies, further fueling market growth. Countries such as India, China, Japan, and South Korea have a major impact on the growth of the market of the region due to higher demand for plant-based meat alternatives and rising technology and development in the functional non-meat ingredients segment.

Europe is expected to experience Notable Growth in the foreseeable period

Europe is observed to have a notable growth in the functional non-meat ingredients market in the foreseen period due to higher demand for plant-based alternatives for meat and protein, higher demand for clean-label products, and growing health-conscious consumers. The regional market is also observed to be growing due to the increasing number of consumers following a vegan or flexitarian diet. High demand for clean-label products, moisture retention, and enhanced taste are other major factors driving market growth. Countries such as Germany, France, and the UK play a major role in the region's market growth due to rising health consciousness, which supports the market’s growth.

Functional Non-Meat Ingredients Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 4.6% |

| Market Size in 2025 | USD 126.57 Billion |

| Market Size in 2026 | USD 132.39 Billion |

| Market Size by 2034 | USD 189.72 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Functional Non-Meat Ingredients Market Segmental Analysis

Ingredient Analysis

The binders and extenders segment dominated the functional non-meat ingredients market in 2024 due to factors such as improved food taste and texture, enhanced juiciness, maintaining moisture, and reducing shrinkage, along with improving the quality and volume of meat alternatives. Such factors enhance market growth while lowering production costs, further fueling it.

The protein segment is expected to grow over the forecast period due to rising technology supporting the manufacturing of innovative products, along with emerging manufacturing and processing techniques. The market is also expected to grow due to high demand for plant-based meat and protein options, driven by health-conscious consumers. Such supportive factors primarily fuel the market's growth.

Function Analysis

The water binding and retention segment led the functional non-meat ingredients market in 2024 due to multiple benefits of the segment, such as avoiding separation, improving structure, reducing losses, improving yields, along with the stabilized mixture of protein, fat, and water. The segment also pays attention to the taste and texture of the functional non-meat ingredients, further fueling the growth of the market.

The fat-reduction and replacement segment is expected to grow over the forecast period due to improved fatty acid profiles, lower calories, lower trans fats and cholesterol, and other beneficial health factors. There is no difference in the taste or texture of the ingredients, even with such beneficial pointers, which further fuels market growth.

Source Analysis

The plant-based segment led the functional non-meat ingredients market in 2024 and is also expected to grow fastest in the foreseen period due to factors such as higher demand for plant-based meat and protein options, higher demand for clean-label products, improving technology for new product innovation, and rising health consciousness. The improving technology helps to maintain the taste, texture, and density of functional non-meat ingredients, further fueling the growth and stability of the market.

Distribution Channel Analysis

The direct B2B sales segment dominated the functional non-meat ingredients market in 2024 due to higher demand for offline shopping and higher demand for offline stores, leading to higher profits. The market is also seeing growth driven by rising health awareness and expanding partnerships with the food industry. The segment also helps enhance consumer loyalty, further fueling market growth.

The online channels segment is expected to grow over the foreseeable period due to the platform's convenience. The market is also observed to be growing due to the rise of e-commerce platforms, the growing culture of online shopping, detailed product information, and the easy availability of different types of products.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Functional Non-Meat Ingredients Market

- Kerry Group – Kerry Group develops a wide range of functional ingredients and systems for meat and alternative protein applications. Its non-meat ingredient portfolio includes binders, stabilizers, flavors, and texture enhancers, designed to improve juiciness, flavor, and mouthfeel in processed meat and plant-based formulations.

- Ingredion Incorporated – Ingredion provides starches, hydrocolloids, and texturizing systems used as binding and water-retention agents in processed meats and analogs. The company emphasizes clean-label and plant-based ingredient innovation, enabling improved functionality and sensory appeal.

- Cargill – Cargill supplies proteins, starches, hydrocolloids, and emulsifiers for enhancing texture, stability, and juiciness in meat and non-meat products. Its focus includes sustainable plant proteins and functional blends for improved product structure and shelf life.

- ADM (Archer Daniels Midland Company) – ADM produces soy, pea, and wheat proteins, along with texturizing agents, emulsifiers, and flavor solutions. Its non-meat ingredients support moisture management, binding, and flavor enhancement in plant-based and hybrid meat products.

- ICL Food Specialties – ICL offers phosphate and protein systems for improving texture, water-binding, and stability in meat and poultry products. The company’s solutions support yield optimization and functional consistency in processed foods.

- Wenda Ingredients – Wenda specializes in functional and natural ingredient systems including antioxidants, antimicrobials, and flavor enhancers. Its clean-label technologies improve shelf life, juiciness, and safety in processed meat and non-meat applications.

- Essentia Protein Solutions – Essentia provides collagen, bone broth, and functional animal proteins that enhance texture, mouthfeel, and nutritional value in meat and plant-based products. Its ingredients contribute to emulsification, binding, and water retention performance.

- DowDuPont (IFF) – IFF (formerly DuPont Nutrition & Biosciences) supplies hydrocolloids, enzymes, and protein systems that improve texture, juiciness, and stability. Its focus on clean-label formulation and plant-based innovation makes it a key player in the functional ingredients space.

- Corbion N.V. – Corbion develops lactic acid-based preservatives, emulsifiers, and functional blends used to improve shelf life and microbial stability in processed meats and alternative proteins. The company promotes natural preservation and sustainability.

- Tate & Lyle – Tate & Lyle offers starches, fibers, and stabilizers that enhance binding, mouthfeel, and water control in meat analogs and prepared foods. Its portfolio supports low-fat and clean-label formulations for health-oriented products.

- Ashland Global Holdings – Ashland produces cellulose derivatives, hydrocolloids, and specialty polymers that improve texture, viscosity, and moisture retention in processed foods, including meat and plant-based protein applications.

- DSM Nutritional Products – DSM provides enzymes, vitamins, and bioactive compounds that enhance nutritional value, color stability, and functionality in processed foods. The company’s solutions are used in fortified and plant-based meat alternatives.

- Kemin Industries – Kemin supplies antioxidants, antimicrobials, and shelf-life extension systems for meat and non-meat products. Its ingredients help maintain flavor stability, color, and freshness throughout processing and storage.

- Givaudan – Givaudan offers flavor, masking, and texture systems that enhance taste and mouthfeel in processed and alternative proteins. Its expertise in sensory optimization supports the development of next-generation meat analog formulations.

- Ajinomoto Co., Inc. – Ajinomoto produces amino acids, flavor enhancers, and umami-based ingredients used to boost flavor depth and palatability in processed meats and plant-based alternatives.

- Chr. Hansen Holding A/S – Chr. Hansen develops natural cultures, enzymes, and fermentation-based ingredients that improve flavor, color, and preservation. Its microbial technologies are used across meat, dairy, and plant-based categories.

- BASF SE – BASF offers functional nutritional and texturizing ingredients, including vitamins, lipids, and colorants, that enhance stability, appearance, and nutritional balance in processed food systems.

- Lonza Group – Lonza provides bioactive compounds and encapsulation technologies that improve functional performance and nutrient delivery in food products, including non-meat applications.

- Sensient Technologies – Sensient develops natural colors, flavor systems, and coating agents used to improve sensory appeal and product differentiation in meat and non-meat foods.

- Jungbunzlauer – Jungbunzlauer supplies organic acids, gluconates, and hydrocolloids that act as natural preservatives, stabilizers, and texturizers in processed and plant-based foods. Its products align with clean-label and sustainable formulation trends.

Segments Covered in the Report

By Ingredient Type

- Binders & Extenders

- Phosphates

- Proteins

- Starch

- Hydrocolloids

- Antioxidants

- Flavoring Agents

- Coloring Agents

- Salts

- Preservatives

- Sweeteners

- Acidulants

- Others

By Function

- Water Binding & Retention

- Flavor Enhancement

- Color Stabilization

- Texture Modification

- Shelf-Life Extension

- Fat Reduction & Replacement

- Others

By Source

- Plant-Based

- Animal-Based

- Synthetic

- Microbial

- Others

By Distribution Channel

- Direct Sales (B2B)

- Distributors & Wholesalers

- Retail / Specialty Stores

- Online Channels

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5805

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.